Whenever GROUNDFLOOR was only getting started 5 years before, critics and cynics objected with what we nicknamed the new Groucho Marx condition — we.elizabeth. the theory that no debtor i need would ever before take on good financing out of us. Offered, it was genuine back then we was in fact limited regarding the size of financing we are able to funds, the pace we can provide, and also the big date it got to shut.

Once we managed those limits from the being qualified our offering into SEC and you may increasing our earliest round away from capital raising resource in 2015, the brand new critics emerged to say that while we would be ready so you can give for the an area industry in the a little measure, we are able to never ever lend all over the country from inside the huge number versus reducing financing quality. Inside the 2016, i set out to build a credit businesses party (along with exposure administration, underwriting, and you may resource administration) for the professional options, regulations, equipment and processes doing that. Our aim was to boost loan top quality and you can frequency simultaneously, really beyond our home market.

We’ve been financing to have several years today, and you will credit generally in non-Atlanta urban area Year In the Review ways, frequency has exploded somewhat.

Vintages

To answer you to matter, i examined finance paid nevertheless an excellent that people came from (Antique A), and you will compared they to fund began into the period (Antique B), leaving out financing which were got its start as the that haven’t yet , reached readiness. Excluding those individuals fund stops skewing the latest results inside GROUNDFLOOR’s favor, once the it’s too soon to learn how good might sooner create. The fresh cost condition for vintages was reported and you will counted because away from , but where listed.

Classic Good includes 88 seemingly brief, mainly local Atlanta-city money originated throughout GROUNDFLOOR’s formative age, a period of 31 days (2.five years).

Classic B, by comparison, includes 222 money that have been got its start following all of our introduction and you may application of greater credit solutions. This antique is over dos.5X large, and is actually started throughout 24 months (2 yrs, good 20% smaller time).

Abilities Size #1: Internet Give

There are 2 a way to level overall performance from financing collection. Basic, and most notably, buyers wish to know just what produce this new loans put. What size was any losings according to the new asked produce? Of several traders are able to accept loss toward a fraction of financing during the a collection, as long as those individuals losings are good enough offset from the yield understood for the finance that do pay in full.

The difference into the contract rates amongst the vintages is tall. The new disappear off Antique A to Antique B is partly attributable towards the lingering compressing of productivity throughout the financing field i serve. A very essential determine, yet not, has been a proper solution to pursue a knowledgeable and more than knowledgeable individuals of the decreasing cost through the years. We’re going to touch upon this type of character during the greater detail during the an excellent coming blog post.

Show Scale #2: Timeliness from Payment

Plus net produce, buyers use to the-date percentage metrics as a different indication out of collection results. Most of the finance originated from one another vintages is deferred percentage finance. That implies zero commission flow from before mortgage grows up, we.e. up to their finally payment deadline. GROUNDFLOOR has recently introduced payment loans because something new. Upcoming analyses will for this reason check out the ongoing percentage show ones funds since a group, however, there are no payment financing in a choice of of them vintages.

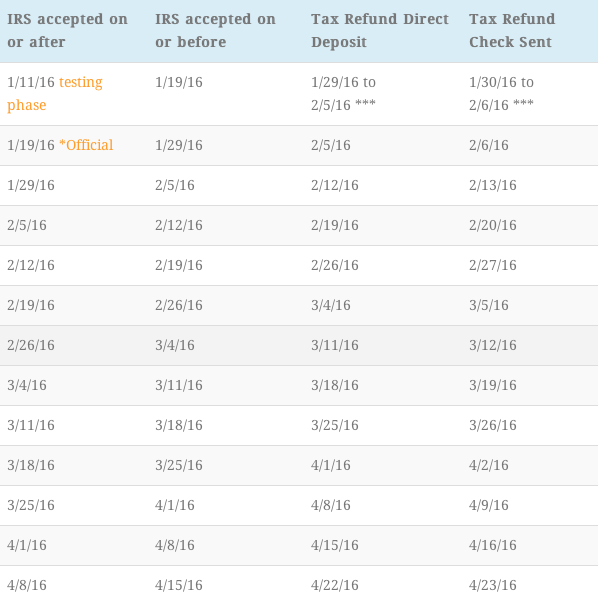

For each and every classic, we assessed whenever financing paid back regarding its readiness schedules. Let me reveal an assessment of one’s timeliness off payment to have Antique A good and you can Vintage B, having rates provided to fall apart this new share of paid off funds.

Going then, we along with re-went the research to add financing that were nonetheless an excellent away from for every antique since . To obtain the cleanest (toughest) scale you’ll be able to, we excluded 46 a good financing which had not yet hit readiness (zero borrowing from the bank for those!), however, integrated twenty eight which were a fantastic however, previous readiness (given that, hey, these include later!).

This new denominator the audience is playing with to evaluate the present day condition your performance, Line 5 above, is Range 2 including Line cuatro, or if you prefer Range 1 without Line 3, and additionally Line 4. Listed here is a snapshot of your own problem by :

Results & Comparison

Our developments for the risk administration, underwriting and advantage government make a big change to own GROUNDFLOOR people. Despite more increasing the speed out of originations, on-go out fees (Paid down Ahead of Readiness) is up over 27% in order to 71.6% off 49.3%. Even when the a fantastic overdue mortgage into the Cohort B went ninety days later or higher, which is highly unrealistic if the officially you’ll, we had still comprehend a good 6.8% change in money over ninety days later (from 29.8% down seriously to 25.0%).

Significantly more notably, even after high development in origination equipment regularity, the lending procedures team has returned capital to your 148 money in Classic B no death of dominating, if you’re getting an internet give from % an average of where same antique.

Conclusion

The information and knowledge quantifies everything we have already read from many of you. GROUNDFLOOR made high developments within the lending and house government just like the 2016. Actually, those individuals developments was in fact recognized by our very first institutional whole mortgage consumer whom finalized with our company immediately following completing several months off due diligence on the our group, formula, procedure and you can collection.

But, we’re not ending here. We know there is certainly however improvements to-be produced and therefore there’s always space getting upgrade. While we continue while making assets in our tech, procedure, regulations and ability, traders can be and may predict much more surface and reliability inside the whatever you would.

GROUNDFLOOR will continue to grow during the 2018, however, we wouldn’t prevent improving — and you may sharing loans in Peetz the information and knowledge that displays how we have been creating. In the future, we propose to publish more info about how exactly i underwrite and you will carry out new funds i originate and an analysis of your precision inside predicting the ultimate marketing rates (the brand new Immediately after Fix Worthy of or ARV) as the an efficiency of your own procedure. Be mindful of the latest GROUNDFLOOR web log as well as your email address to have all of our 2nd article, and make use of the comments below so that us know what else you may like to discover.